Call: 01792 001350

Specialist 3D Printing Company Insurance for UK Innovators

Protect your printers, prototypes, IP and reputation with tailored cover built for 3D printing companies – not generic manufacturers.

Whether you’re printing bespoke prototypes, end-use components or medical-grade parts, a standard off-the-shelf policy is rarely enough. 3D printing businesses face a unique mix of product liability, design errors, cyber risk and intellectual property exposure.

At Miller & Partner, we arrange specialist 3D printing company insurance in the UK designed around how you actually operate.

Why 3D Printing Companies Need Specialist Insurance

The UK 3D printing sector is growing fast across automotive, aerospace, medical devices, engineering and consumer products. That growth brings opportunity – but also new risks that traditional policies often overlook.

Key risks for 3D printing companies include:

Product failure & recalls – a printed component fails in use, causing property damage, financial loss or injury.

Design errors & faulty specifications – a CAD or design flaw leads to costly rework, delays or client claims.

Who we cover

Insurance for All Types of 3D Printing Businesses

We work with a wide range of 3D printing and additive manufacturing operations across the UK, including:

Industrial 3D printing and contract manufacturers

Rapid prototyping studios and product development labs

Medical, dental and healthcare 3D printing providers

Engineering and aerospace component manufacturers

Design-led 3D printing businesses and bureaus

Startups and scale-ups using additive manufacturing as a service

If your business uses 3D printing as a core part of what you do, we can help you build the right insurance programme.

What Your 3D Printing Company Insurance Can Include

Most 3D printing firms need a blend of covers – not a single policy. We’ll help you combine the right protections into one joined-up package.

Key elements can include:

Product Liability Insurance

Protection if a part or prototype you produce causes injury or property damage. Essential if your components go into critical applications such as automotive, aerospace or medical devices.

Professional Indemnity Insurance

Covers claims arising from design errors, inaccurate specifications, CAD mistakes or professional advice that leads to a client’s financial loss.

Employers’ Liability Insurance

A legal requirement in the UK if you have staff. Protects against claims for workplace injury or illness.

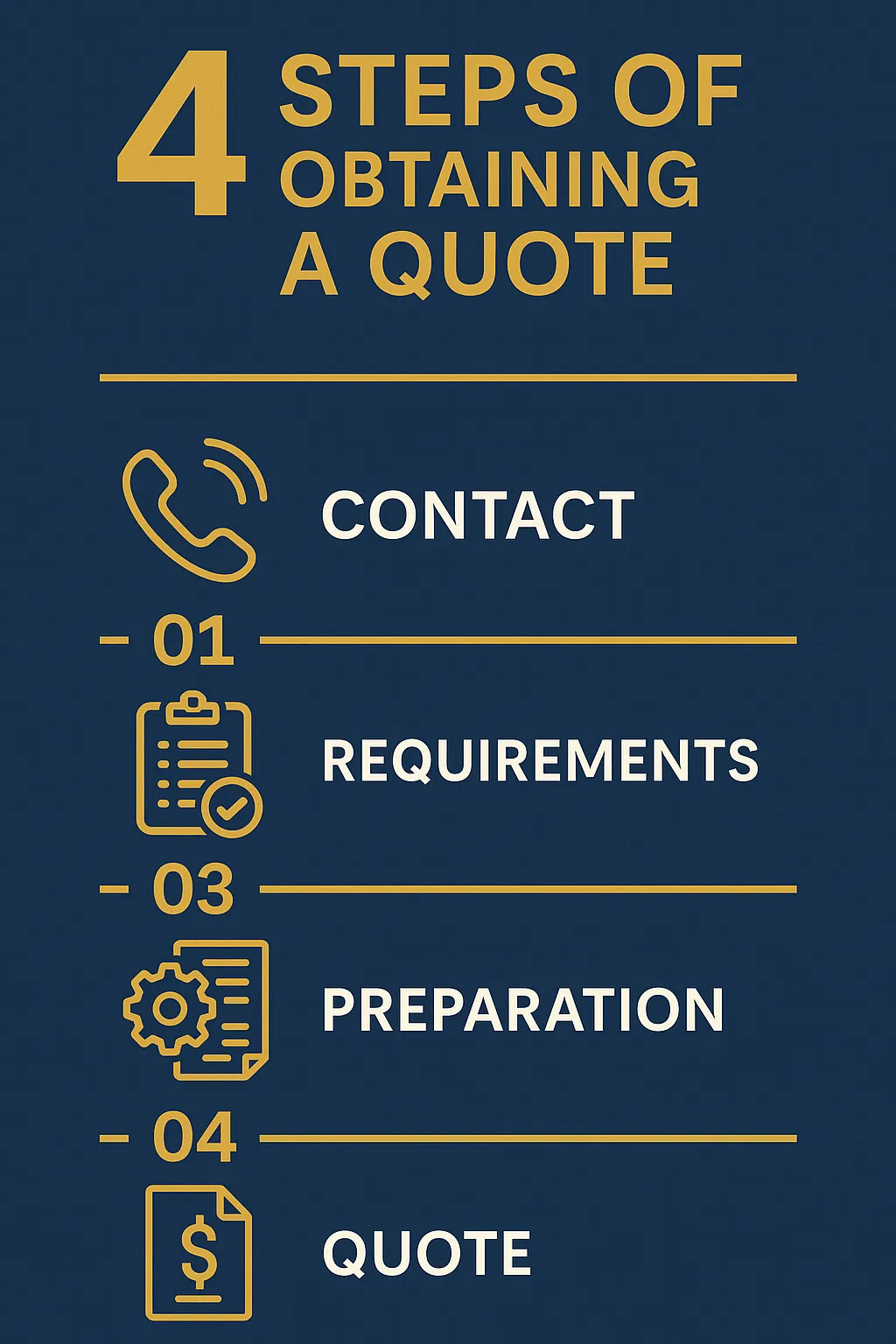

How Our Process Works

We keep the process simple and focused on you, so you can get back to running your business.

Step 1 – Discovery Call

We learn how your operation works: what you print, who for, equipment values, sectors you serve (e.g. medical, aerospace, automotive), and your current insurance arrangements.

Step 2 – Market Search & Risk Review

We approach suitable UK insurers and specialist markets on your behalf, comparing terms, conditions and exclusions with a focus on 3D printing exposures.

Step 3 – Tailored Recommendations

We present clear options, highlighting the differences in cover – not just the price. You’ll know exactly what’s protected and where any gaps may be.

Step 4 – Ongoing Support & Claims Help

Once you’re on cover, we’re here for mid-term changes, renewals and claims support – helping you navigate the process and get outcomes as quickly as possible.

Why Work With Miller & Partner?

Specialist understanding of tech and advanced manufacturing

We focus on modern, emerging sectors and understand the specific risks of additive manufacturing.Independent, FCA-regulated insurance broker

We’re not tied to one insurer – we search the market on your behalf and work only in your best interests.Access to leading UK insurers and Lloyd’s markets

This helps us source specialist wordings and more tailored solutions for complex 3D printing risks.Clear, plain-English explanations

No jargon, no confusion – just straight answers about what is and isn’t covered.Human service, enhanced with technology

We use technology and AI behind the scenes to make things faster and more accurate, while you still deal with real people who know your business. 1

Protect Your 3D Printing Business Today

Get a 3D Printing Insurance Quote

Share a few details about your business and we’ll come back to you with tailored options from UK insurers and specialist markets.

Contact details:

Miller & Partner Limited – Commercial Insurance Brokers

Telephone: 01792 001350

Email: [email protected]

Office: Vivian House, Roman Bridge Close, Mumbles, Swansea, SA3 5BG

Interacted with Miller and Partner on LinkedIn regarding my public liability insurance. After a brief chat about my requirements 2 deals were done at I would say better than reasonable rates. Highly recommend this company for all your insurance needs.

3D Printing Insurance - Common Questions We Get Asked

Q: Is employers’ liability insurance compulsory?

A: Yes – if you employ anyone in the UK, even part-time, employers’ liability insurance is a legal requirement.

Q: We mainly design and prototype – do we still need product liability?

A: In most cases, yes. If a prototype or part you produce is used, tested or relied upon and then fails, you may still face claims for damage or loss.

Q: We store client CAD files and sensitive designs – is that covered?

A: Standard policies may not fully address cyber and IP risks. We’ll look at cyber and intellectual property cover to ensure these exposures are properly protected.

Q: Can you work with startups and early-stage 3D printing businesses?

A: Absolutely. We work with startups and growing firms as well as established manufacturers, and can help you build a scalable insurance strategy as you expand.

Q: How quickly can cover be arranged?

A: Once we have the information we need about your business, we can normally obtain terms and arrange cover very quickly, depending on the complexity of your operation and the insurers involved.

Office: Vivian House, Roman Bridge Close, Mumbles, Swansea, SA3 5BG

Call 01792 001350

Email: [email protected]