Call: 01792 001350

Solar Panel Installation Insurance – Specialist Cover for UK Solar Installers

Protect your business, clients and reputation with tailored insurance designed specifically for professional solar panel installation businesses.

Who is this for?

This page is for professional solar panel installers & renewable energy installation businesses across the UK, including:

Domestic solar panel installers

Commercial solar installation companies

Rooftop and ground-mounted solar specialists

Businesses offering solar PV installation, maintenance, testing and commissioning services

Whether you’re just starting out or expanding your installation services, you need specialist insurance that understands the unique risks in your industry.

Why solar panel installers need insurance?

Running a solar panel installation business exposes you to many risks that standard business insurance doesn’t cover. From accidental damage to customer property, to injuries, faulty workmanship claims or equipment loss, you need an insurance partner who understands solar installers’ specific exposures.

Specialist solar panel installation insurance can include cover such as:

Public Liability Insurance – Protection if a customer or member of the public claims for injury, damage or loss related to your business activities.

Contractors’ All Risks Cover – Protects you if installed panels, materials or works in progress are damaged, stolen or destroyed.

Professional Indemnity Insurance – Covers claims arising from design errors, incorrect advice or specification issues.

Employers’ Liability Insurance – A legal requirement if you have staff, covering claims from employees injured at work.

Products Liability Insurance – Protection if installed systems later cause injury or property damage.

Tools, Plant & Equipment Cover – Cover for tools, testing equipment, lifting gear and specialist installation equipment.

Business Interruption & Additional Covers – Optional covers to protect your income and ongoing business risks.

These specialist policies are designed for your trade — they protect you, your business and the clients who trust you with their property.

Key Covers We Can Arrange for Solar Panel Installation Businesses

1. Public Liability Insurance

Protects you if a claim is made against you for accidental injury to clients, damage to property, or incidents arising from your installation work. Public liability for solar installers typically includes work at height, heat works and third-party property damage.

2. Contractors’ All Risks Cover

This is specialist protection for materials, panels and ongoing installation projects — covering loss or damage that standard liability policies often exclude.

3. Employers’ Liability Insurance

If you employ anyone — even part-time — this cover protects against claims from your staff if they’re injured while working.

Frequently Asked Questions (FAQs)

Do I really need solar panel installation insurance?

Yes. Installation work involves electrical systems, working at height and customer property where things can go wrong. Specialist insurance protects you, your clients and gives credibility to your business.

Does public liability cover faulty solar installations?

Yes — specialist policies can include cover for accidental damage, injury and resulting losses caused by your installation work.

Is employers’ liability mandatory?

If you have staff, yes — employers’ liability is a legal requirement in the UK.

Can I insure both domestic and commercial solar work?

Absolutely — policies can be tailored for residential, commercial and industrial solar installations.

Why Work With Miller & Partner for Solar Panel Installation Insurance?

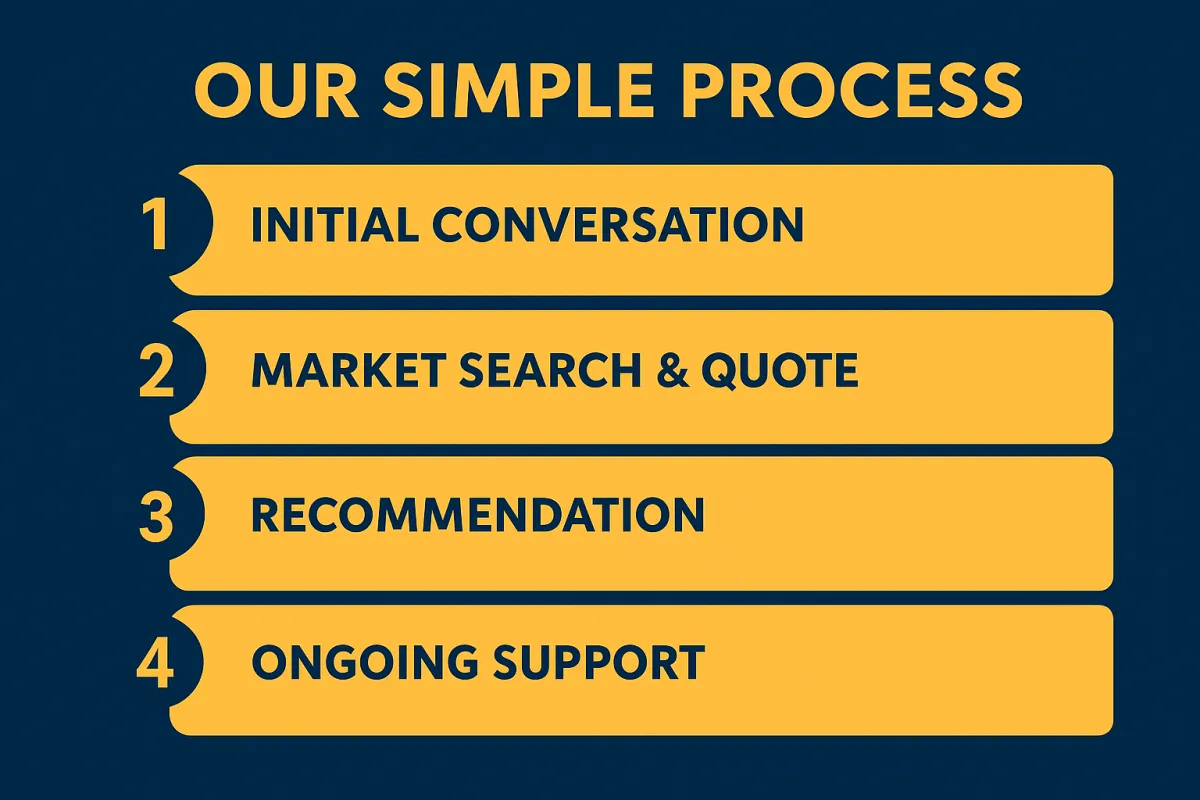

We’re a UK-based commercial insurance broker with specialist knowledge of renewable energy and contractor risks. We work with top insurers to design policies that reflect how you operate — whether domestic, commercial or large-scale installations.

Tailored quotes for your business

Specialist knowledge of solar installation risks

Access to niche markets and insurers

Fast, human support when you need it

No off-the-shelf limitations

Get in touch today for a chat. We will talk you through your requirements and ensure you are getting the exact cover you require and always at the lowest possible premium.

Office: Vivian House, Roman Bridge Close, Mumbles, Swansea, SA3 5BG

Call 01792 001350

Email: [email protected]