Call: 01792 001350

Aesthetics & Beauty Business Insurance – Specialist Cover for UK Beauty Professionals

Protect your business, clients and reputation with tailored insurance designed specifically for professional aesthetics and beauty businesses.

Who is this for?

This page is for professional aesthetics and beauty businesses across the UK, including:

Beauty salons and aesthetics clinics

Mobile beauty therapists and makeup artists

Cosmetic dermatology and advanced skin treatment providers

Lash, brow, and cosmetic tattoo specialists

Businesses offering facial, body, and cosmetic treatments

Whether you’re just starting out or expanding your services, you need specialist insurance that understands the unique risks in your industry and the regulatory environment you operate in.

Why aesthetics and beauty businesses need insurance?

Running an aesthetics and beauty business exposes you to many risks that standard business insurance doesn’t cover. From accidental injury during treatments, to claims of dissatisfaction, allergic reactions or equipment loss, you need an insurance partner who understands beauty professionals’ specific exposures.

Specialist aesthetics and beauty insurance can include cover such as:

Public Liability Insurance – Protection if a client or member of the public claims for injury, damage or loss related to your business activities.

Professional Indemnity Insurance – Covers claims arising from advice, treatment outcomes, or professional errors.

Employers’ Liability Insurance – A legal requirement if you have staff, covering claims from employees injured at work.

Product Liability Insurance – Protection if products you use or sell cause harm.

Treatment/Activity Specific Cover – Tailored cover for high-risk procedures like injectables, laser work, or microneedling.

Business Equipment Cover – Protection for specialist equipment, tools and beauty machines.

Business Interruption & Additional Covers – Optional covers to protect your income and ongoing operational risks.

These specialist policies are designed for your trade — they protect you, your business and the clients who trust you with their appearance and wellbeing.

Key Covers We Can Arrange for Aesthetics and Beauty Businesses

Public Liability Insurance

Protects you if a claim is made against you for accidental injury to clients, damage to property, or incidents arising from your beauty treatments or services. In the aesthetics sector, even minor treatments can lead to significant claims if something goes wrong.

Professional Indemnity Insurance

This covers claims arising from professional advice, treatment outcomes, or mistakes in the delivery of beauty services. It’s especially important for regulated and advanced procedures where outcomes are subjective or legally sensitive.

Employers’ Liability Insurance

If you employ anyone — even part-time or freelance staff — this cover protects against claims from your team if they are injured while working. UK law requires this for employers.

Product and Treatment Liability

If a product you apply (e.g., skin serum, filler, or cosmetic product) causes an adverse reaction, or if a treatment results in client dissatisfaction or harm, this insurance can cover the resulting legal costs and compensation.

Business Equipment and Contents Cover

Beauty equipment such as lasers, aesthetic machines, massage beds, and treatment tools are expensive. This cover protects those assets against theft, accidental damage or breakdown.

Business Interruption & Additional Covers

Optional covers such as business interruption, cyber liability, and stock cover help protect your income and operations against unexpected disruptions.

Frequently Asked Questions (FAQs)

Do I really need aesthetics and beauty business insurance?

Yes. Beauty and aesthetics treatments involve close client contact, specialist procedures and equipment, and often licensed or regulated activities. Specialist insurance protects you, your clients and gives credibility to your business.

Does public liability cover treatment outcomes?

Public liability covers accidental injury or property damage to third parties. Treatment outcome issues are typically covered under professional indemnity or treatment liability policies — depending on your specific services.

Is employers’ liability mandatory?

If you have staff, yes — employers’ liability insurance is a legal requirement in the UK.

Can I insure both salon-based and mobile beauty work?

Absolutely — policies can be tailored for treatments delivered at your premises and mobile services at client locations.

Why Work With Miller & Partner for Aesthetics and Beauty Insurance?

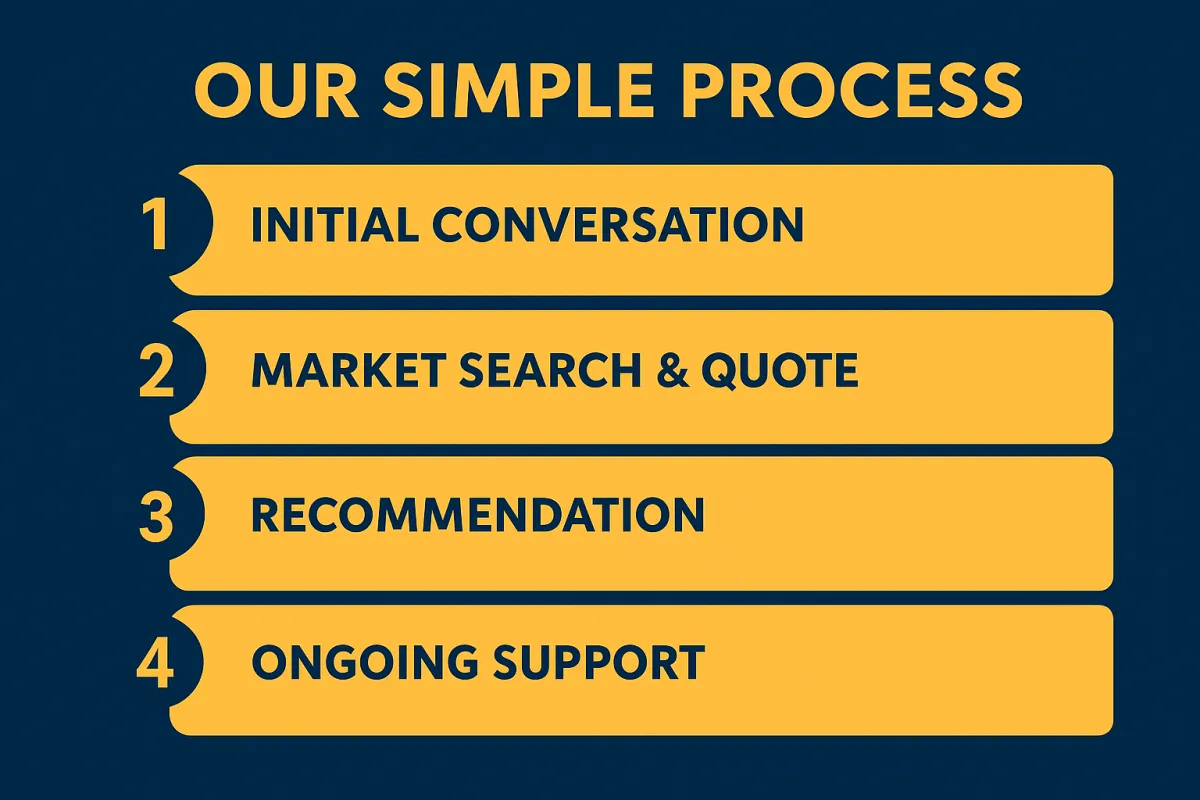

We’re a UK-based commercial insurance broker with specialist knowledge of beauty and aesthetics business risks. We work with top insurers to design policies that reflect how you operate — whether you’re a solo therapist, high-end clinic or multi-location salon.

Tailored quotes for your business

Specialist knowledge of aesthetics and beauty sector risks

Access to niche markets and insurers

Fast, human support when you need it

No off-the-shelf limitations

Get in touch today for a chat. We will talk you through your requirements and ensure you are getting the exact cover you require and always at the lowest possible premium.

Office: Vivian House, Roman Bridge Close, Mumbles, Swansea, SA3 5BG

Call 01792 001350

Email: [email protected]