Call: 01792 001350

Dog Grooming Insurance – Specialist Cover for UK Dog Groomers

Protect your business, clients and reputation with tailored insurance designed specifically for professional dog grooming businesses.

Who is this for?

This page is for professional dog groomers & pet grooming businesses across the UK, including:

Salon-based dog groomers

Mobile dog grooming businesses

Freelance groomers visiting clients’ homes

Businesses offering nail clipping, ear cleaning, teeth cleaning and full grooming services

Whether you’re just starting out or expanding your grooming services, you need specialist insurance that understands the unique risks in your industry.

Why dog groomers need insurance?

Running a dog grooming business exposes you to many risks that standard business insurance doesn’t cover. From accidental injuries to pets in your care, to claims from customers or equipment loss, you need an insurance partner who understands dog groomers’ specific exposures.

Specialist dog grooming insurance can include cover such as:

Public Liability Insurance – Protection if a customer or member of the public claims for injury, damage or loss related to your business activities.

Care, Custody & Control of Animals Cover – Protects you if a pet in your care is injured, goes missing, or passes away.

Veterinary Fees & Related Costs – Covers costs you may be liable for if a dog in your care needs veterinary treatment.

Employers’ Liability Insurance – A legal requirement if you have staff, covering claims from employees injured at work.

Professional Indemnity Insurance – Protection for claims arising from professional mistakes or advice (optional).

Equipment & Tools Cover – Cover for grooming tables, dryers, clippers and other business tools (optional).

Loss of Keys & Business Interruption – Additional optional covers to protect everyday business risks.

These specialist policies are designed for your trade — they protect you, your business and those who entrust their pets to you.

Key Covers We Can Arrange for Dog Grooming Businesses

1. Public Liability Insurance

Protects you if a claim is made against you for accidental injury to clients, damage to property, or incidents involving pets in your care. Public liability for groomers typically includes veterinary fees, disappearance, advertising and reward payments if an animal goes missing.

2. Care, Custody & Control Cover

This is specialist protection for animals while they’re with you — covering costs related to injury, loss or unexpected events that standard liability policies often exclude.

3. Employers’ Liability Insurance

If you employ anyone — even part-time — this cover protects against claims from your staff if they’re injured while working.

4. Optional Add-Ons

Professional Indemnity – liability for professional advice or errors.

Equipment, stock & tools cover – protects your business assets.

Frequently Asked Questions (FAQs)

Do I really need dog grooming insurance?

Yes. Grooming involves handling animals and equipment where things can go wrong. Specialist insurance protects you, your clients and gives credibility to your business.

Does public liability cover injuries to the dogs?

Yes — specialist policies can include cover for vet fees, death or disappearance of animals in your care, and even advertising / reward if a dog goes missing.

Is employers’ liability mandatory?

If you have staff, yes — employers’ liability is a legal requirement in the UK.

Can I insure mobile dog grooming?

Absolutely — policies can be tailored for mobile operations as well as fixed-premises groomers.

Why Work With Miller & Partner for Dog Grooming Insurance?

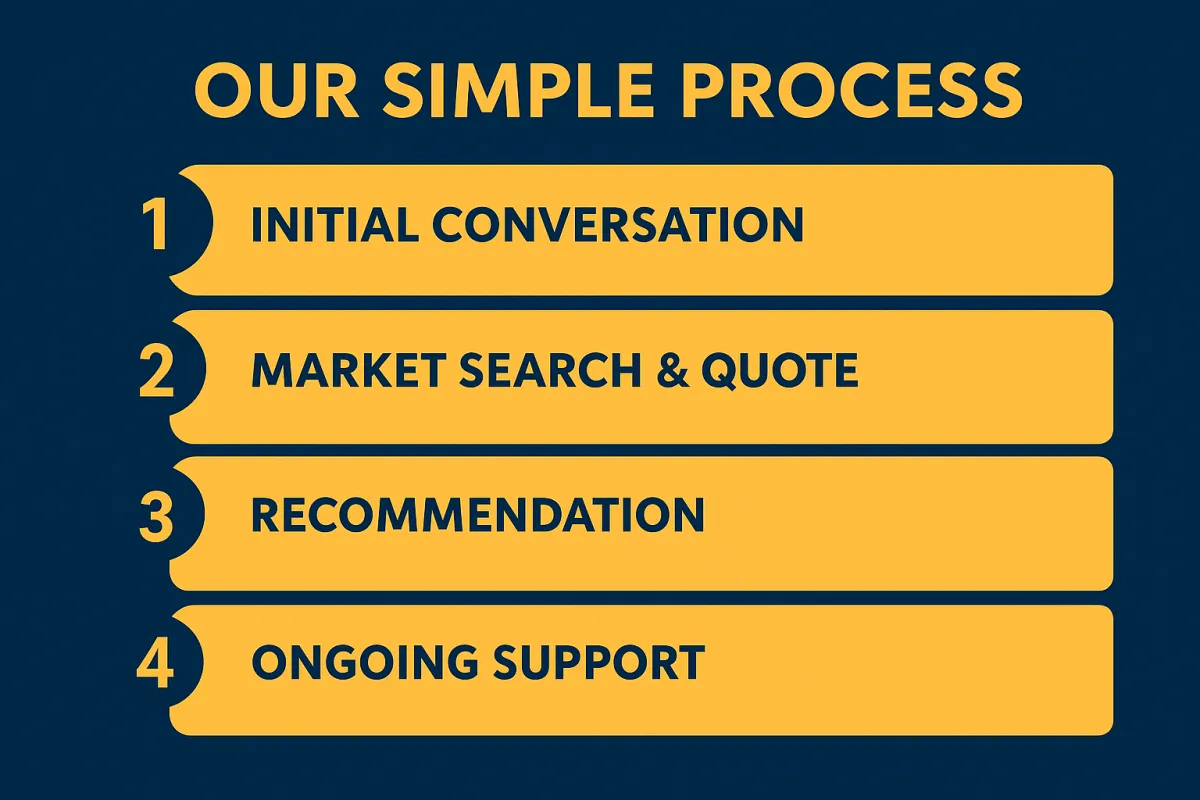

We’re a UK-based commercial insurance broker with specialist knowledge of pet business risks. We work with top insurers to design policies that reflect how you operate — whether from a salon, mobile setup or home.

Tailored quotes for your business

Specialist knowledge of grooming industry risks

Access to niche markets and insurers

Fast, human support when you need it

No off-the-shelf limitations

Get in touch today for a chat. We will talk you through your requirements and ensure you are getting the exact cover you require and always at the lowest possible premium.

Office: Vivian House, Roman Bridge Close, Mumbles, Swansea, SA3 5BG

Call 01792 001350

Email: [email protected]