Call: 01792 001350

Airbnb and Short Let Insurance

Specialist protection for hosts, landlords and property investors

If you rent out a property on Airbnb, Booking.com, Vrbo or as a serviced apartment, standard home or landlord insurance is usually not enough – and can even be invalidated once paying guests stay in your property.

At Miller & Partner, we arrange specialist Airbnb & Short Let Insurance for UK property owners, so you’re properly covered for:

Guest accidents and public liability claims

Damage caused by guests to buildings and contents

Loss of rental income if the property can’t be let after an insured event

Who is this cover for?

Our Airbnb & Short Let Insurance is ideal for:

Homeowners letting out a spare room or annex on Airbnb

Owners of holiday cottages, city apartments or coastal homes

Landlords running serviced accommodation or SA portfolios

Limited companies operating short-term rental businesses.

If you earn money from short stays, this is business activity – and it needs business-grade insurance.

Why you shouldn’t rely on Airbnb AirCover alone

Platforms like Airbnb offer AirCover and other host protection schemes, but they’re not regulated insurance policies and come with important exclusions and limitations.

Common gaps include:

No cover for many types of property damage or all guest-related incidents

Limited or no loss of income cover

Restrictions around common areas in blocks of flats

No access to the Financial Ombudsman Service if you’re unhappy with a decision

Our job is to help fill those gaps with proper insurance designed for short-term lets.

Key benefits of using Miller & Partner

Specialist UK commercial broker – we understand short-let and serviced accommodation risks

Access to multiple insurers and schemes for Airbnb, holiday lets and serviced apartments

We take the time to understand your:

Property type(s)

Platforms used (Airbnb, Booking.com, Vrbo, direct bookings, etc.)

Annual rental income and occupancy patterns

Whether you live in the property, let it fully, or run a portfolio

Human support when it matters – help with adjustments, renewals and claims support

Ability to look at mixed portfolios (ASTs, HMOs, short lets and commercial units) under one broker

What does Airbnb & Short Let Insurance typically cover?

Every policy is tailored, but we’ll usually look to include:

Core property cover:

Buildings insurance – fire, flood, storm, escape of water and other insured perils

Contents insurance – furniture, appliances and fixtures you provide for guests

Cover for unoccupied periods between bookings (often more generous than standard home insurance)

Liability & guest cover

Public liability insurance – protection if a guest or visitor is injured or their belongings are damaged and they pursue a claim

Employers’ liability where required – for cleaners, maintenance staff or key-holders

Option to insure guest-caused accidental or malicious damage, depending on insurer appetite

Income & business protection

Loss of rental income if your property can’t be let after an insured event (e.g. fire, flood, major escape of water)

Alternative accommodation costs where included – if guests need rehousing following an insured incident.

Typical risks we can help you protect against

A guest trips on a loose step and suffers a serious injury, then brings a compensation claim

A party booking leaves malicious damage to furniture, doors and flooring

A burst pipe while the property is empty causes major water damage and you lose months of bookings

A fire in a neighbouring property leads to denial of access, cancelled stays and lost income

A cleaner is injured while working at the property and you face an employers’ liability claim.

With the right insurance in place, these kinds of events are far less likely to become business-ending problems.

Get a quote for Airbnb & Short Let Insurance

Ready to protect your Airbnb or short-term let properly?

Miller & Partner Limited

Phone: 01792 001350

Website: millerandpartner.co.uk

Or use our Quick Quote page to send your details and renewal date

Click below to request your Airbnb & Short Let Insurance quote and we’ll come back to you with options.

Interacted with Miller and Partner on LinkedIn regarding my public liability insurance. After a brief chat about my requirements 2 deals were done at I would say better than reasonable rates. Highly recommend this company for all your insurance needs.

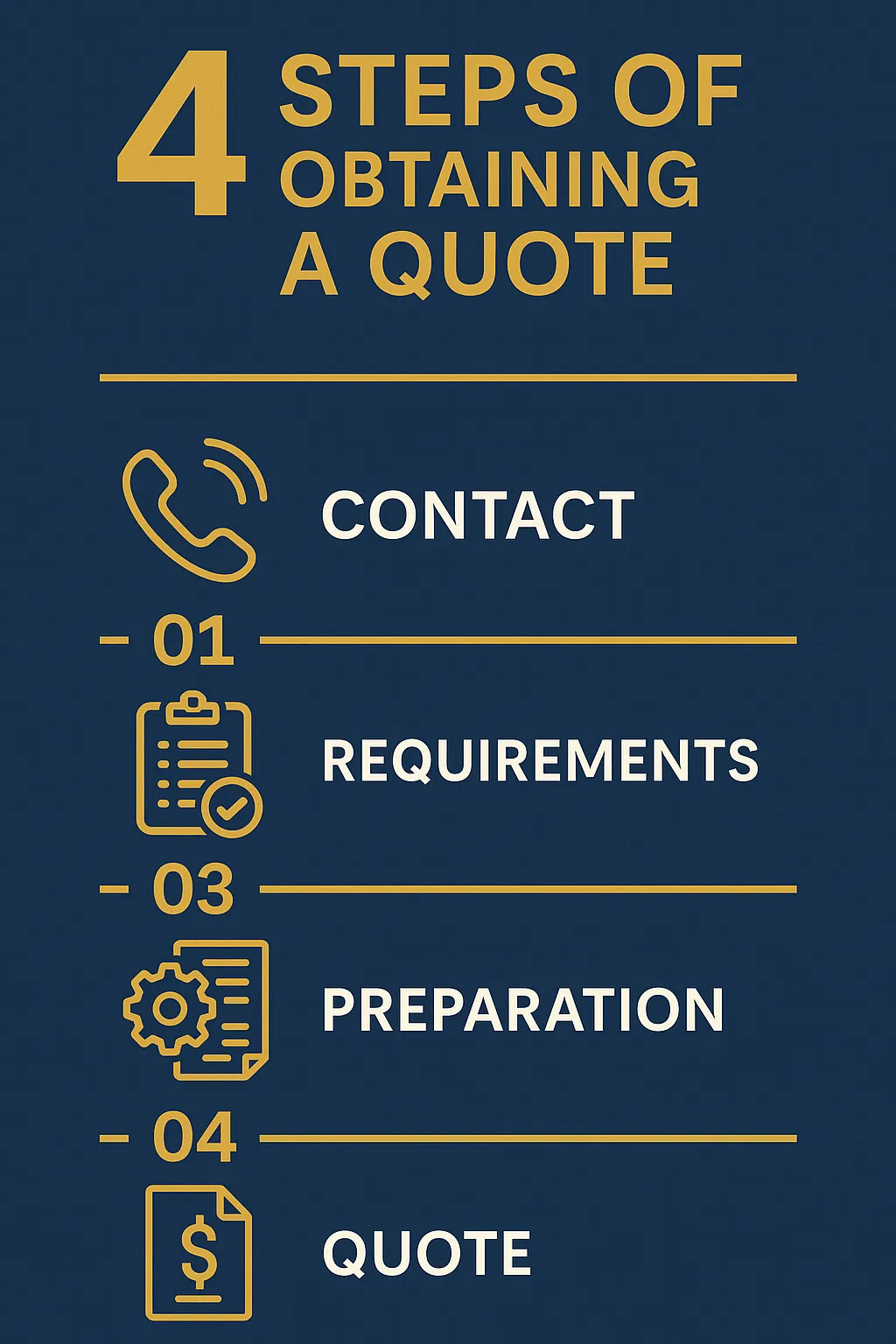

What we’ll ask you for

To get started quickly, we’ll usually need:

Property address and construction details.

How you let it (whole property, rooms only, live-in host, serviced accommodation, etc.)

Platforms used – Airbnb, Booking.com, Vrbo, direct bookings, managing agents

Estimated annual rental income and typical occupancy

Any claims in the last 3–5 years

From there, we can approach suitable insurers and negotiate terms on your behalf.

Office: Vivian House, Roman Bridge Close, Mumbles, Swansea, SA3 5BG

Call 01792 001350

Email: [email protected]