Call: 01792 001350

Mould Removal Business Insurance – Specialist Cover for UK Mould Removal Contractors

Protect your business, clients and reputation with tailored insurance designed specifically for professional mould removal and remediation businesses.

Who is this for?

This page is for professional mould removal contractors & remediation businesses across the UK, including:

Residential mould removal specialists

Commercial mould remediation contractors

Freelance mould removal technicians working on-site

Businesses offering inspections, treatment, cleaning, sealing and prevention services

Whether you’re just starting out or expanding your mould removal services, you need specialist insurance that understands the unique risks in your industry.

Why mould removal businesses need insurance?

Running a mould removal business exposes you to many risks that standard business insurance doesn’t cover. From accidental damage to property, to health-related claims, contamination issues or equipment loss, you need an insurance partner who understands mould removal contractors’ specific exposures.

Specialist mould removal business insurance can include cover such as:

Public Liability Insurance – Protection if a client or third party claims for injury, damage or loss arising from your business activities.

Professional Indemnity Insurance – Covers claims arising from professional advice, reports, treatment methods or alleged failures.

Treatment & Contamination Risks Cover – Protection relating to mould spores, cross-contamination and remediation works.

Employers’ Liability Insurance – A legal requirement if you have staff, covering claims from employees injured at work.

Tools, Equipment & Machinery Insurance – Protection for extraction units, air scrubbers, PPE and specialist tools (optional).

Contract Works & Business Interruption – Additional optional covers to protect everyday business risks.

These specialist policies are designed for your trade — they protect you, your business and the clients who rely on your expertise.

Key Covers We Can Arrange for Mould Removal Businesses

1. Public Liability Insurance

Protects you if a claim is made against you for accidental injury to clients, damage to property, or issues arising from mould removal works. Public liability for mould contractors can include treatment risks, contamination claims and property damage.

2. Professional Indemnity Insurance

Specialist protection for advice, surveys, recommendations and remediation plans — covering claims linked to errors, omissions or alleged failures.

3. Employers’ Liability Insurance

If you employ anyone — even part-time — this cover protects against claims from your staff if they’re injured while working.

4. Optional Add-Ons

Tools, equipment & machinery cover – protects your business assets.

Contract works & business interruption – cover for projects and income protection.

Frequently Asked Questions (FAQs)

Do I really need mould removal business insurance?

Yes. Mould remediation involves health risks, property exposure and specialist treatments. Insurance protects you, your clients and your business reputation.

Does public liability cover mould-related claims?

Yes — specialist policies can include cover for contamination, treatment risks and damage arising from mould removal activities.

Is employers’ liability mandatory?

If you have staff, yes — employers’ liability is a legal requirement in the UK.

Can I insure both residential and commercial mould removal work?

Absolutely — policies can be tailored to cover domestic, commercial and mixed-use projects.

Why Work With Miller & Partner for Mould Removal Business Insurance?

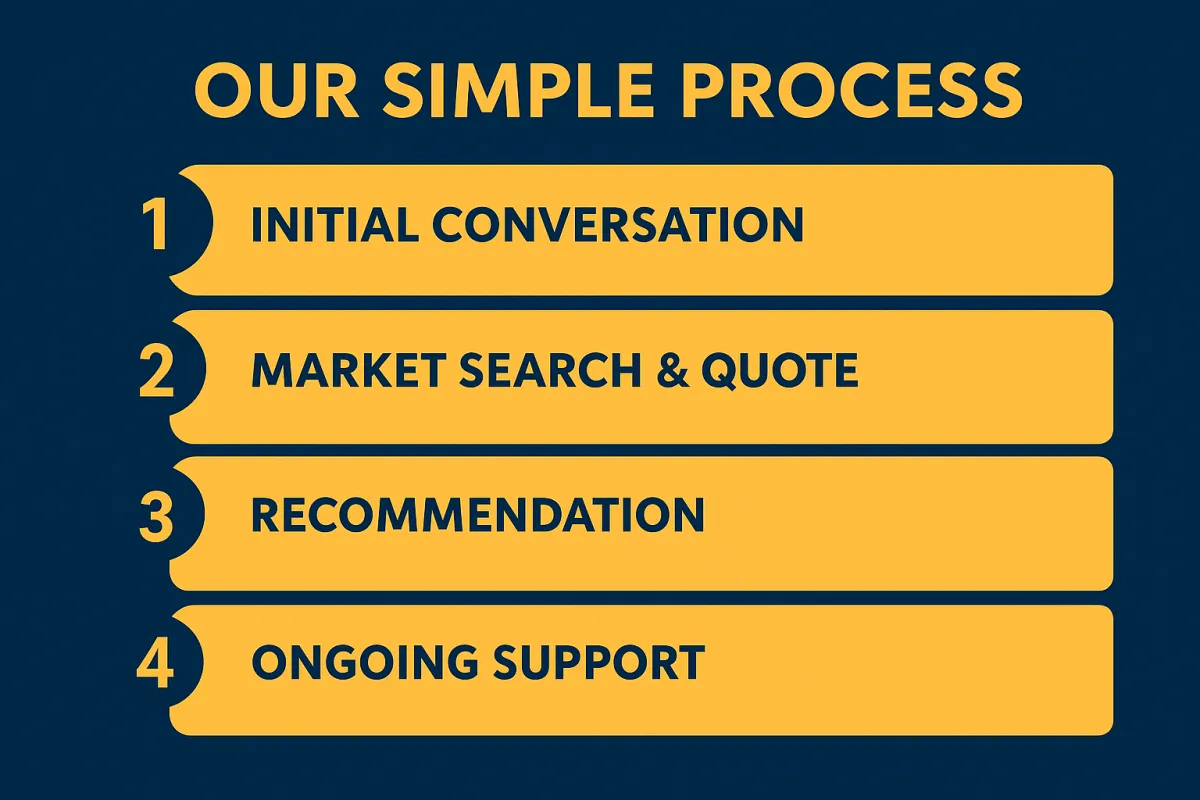

We’re a UK-based commercial insurance broker with specialist knowledge of high-risk trade and remediation businesses. We work with top insurers to design policies that reflect how you operate — whether residential, commercial or specialist projects.

Tailored quotes for your business

Specialist knowledge of mould and remediation risks

Access to niche markets and insurers

Fast, human support when you need it

No off-the-shelf limitations

Get in touch today for a chat. We will talk you through your requirements and ensure you are getting the exact cover you require and always at the lowest possible premium.

Office: Vivian House, Roman Bridge Close, Mumbles, Swansea, SA3 5BG

Call 01792 001350

Email: [email protected]