Call: 01792 001350

Specialist Cyber Insurance for UK Businesses

Protect Your Data, Reputation & Business Continuity with Tailored Cyber Insurance

Whether you’re safeguarding customer data, defending against ransomware, or managing regulatory risk, standard business insurance often falls short. Cyber incidents can lead to crippling costs, lost productivity, regulatory fines and reputational damage — and many general policies exclude cyber exposures.

At Miller & Partner, we arrange specialist cyber insurance in the UK designed around how modern businesses actually operate — not generic, off-the-shelf coverage.

Why UK Businesses Need Specialist Cyber Insurance

Cyber threats evolve constantly — from malware and ransomware to phishing attacks, data breaches, and system outages. Many small and medium-sized businesses wrongly assume they aren’t targets, but hackers automate attacks and don’t discriminate.

Key cyber risks include:

Data breaches & theft of sensitive information.

Ransomware, malware & system encryption.

Business interruption from IT downtime.

Regulatory fines (e.g., GDPR breaches).

Third-party liability and reputational harm.

Standard business policies can exclude or limit coverage for these exposures — specialist cyber insurance fills that gap.

Regulatory & Fines Cover

Helps cover costs from statutory investigations and fines (e.g., under GDPR).

Forensic & Recovery Costs

Supports technical response teams to investigate and recover after an incident.

Crisis Management and PR Support

Helps you manage reputational recovery following a cyber event.

Ransomware & Extortion Protection

Funds and support if systems are held hostage and expert negotiators are needed.

Business Interruption (IT Downtime)

Compensates loss of income and extra expenses when systems cannot operate.

Who we cover

Cyber Insurance for All Types of UK Businesses

We work with organisations of all sizes and in all sectors, including:

Tech companies, SaaS and IT service providers

Professional services (consultants, legal, accounting)

Retailers with online transactions

Healthcare and social care providers

Manufacturers with connected systems

Financial services and fintech firms

SMEs with digital customer data or cloud operations

If your business relies on digital systems, stores data or interacts with customers online, we can help you get the right cyber protection.

What Your Cyber Insurance Can Include

Cyber insurance isn’t a single policy — it’s a package that protects multiple exposures. We help combine the right elements into one joined-up solution:

Cyber Liability & Data Breach Cover

Covers response costs, customer notification, legal fees and damages related to a data breach.

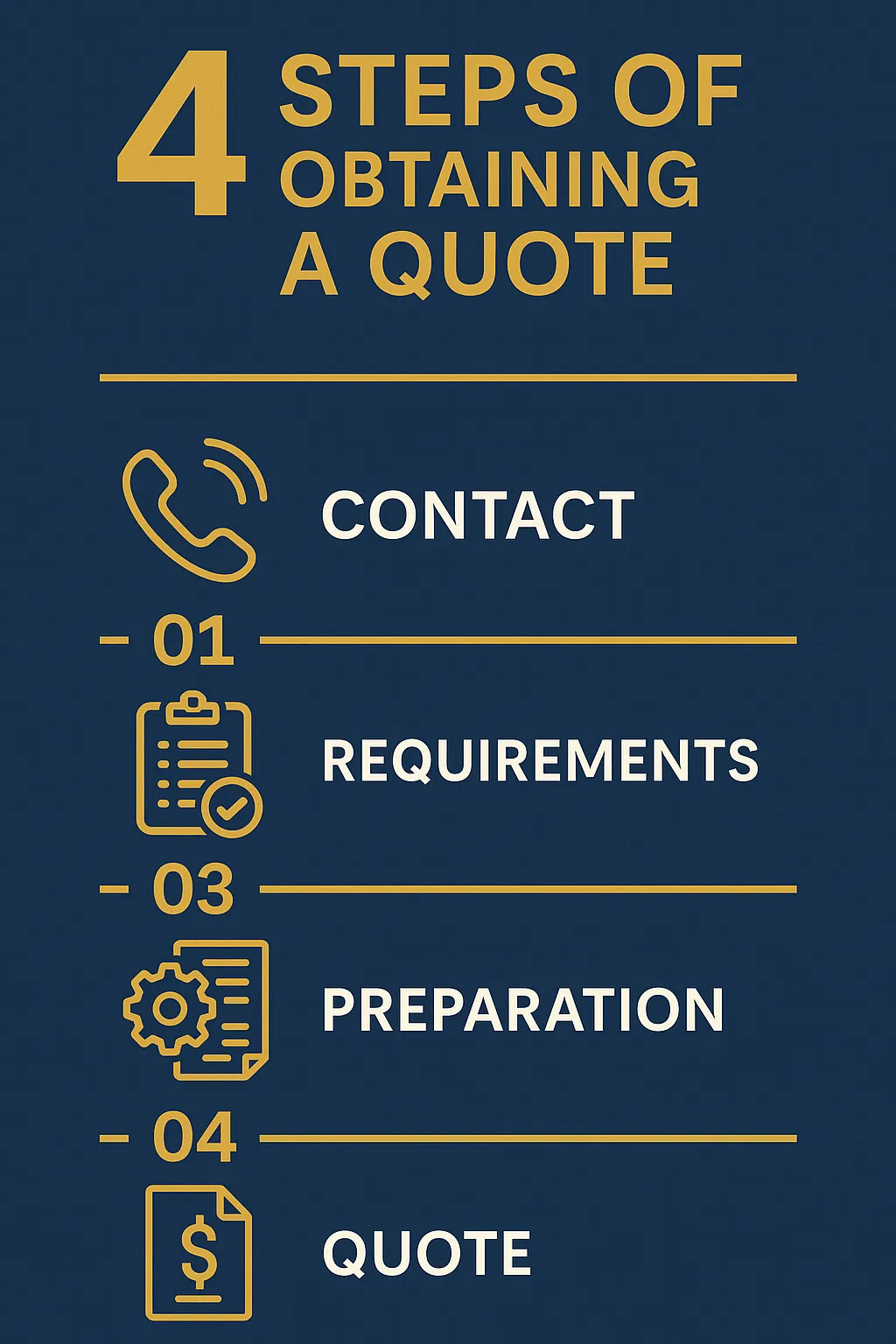

How Our Process Works

We keep the process simple and focused on your business:

Step 1 – Discovery Call

We learn how your business operates, what systems you use, what data you hold and your current protections.

Step 2 – Market Search & Risk Review

We approach specialist UK insurers and cyber markets on your behalf, comparing terms and conditions that match your unique risk profile.

Step 3 – Tailored Recommendations

You receive clear, plain-English options with differences in coverage explained — not just price comparisons.

Step 4 – Ongoing Support & Claims Help

From mid-term updates to renewals and claims support, we’re here throughout the life of your policy.

Why Work With Miller & Partner?

Cyber risk expertise — we understand data, technology and cyber loss scenarios

Independent, FCA-regulated broker — we search the market, not push one insurer

Access to specialist UK insurers & Lloyd’s markets

Clear, jargon-free explanations matched to your business needs

Human service supported with technology for accuracy and speed

Contact details:

Miller & Partner Limited – Commercial Insurance Brokers

Telephone: 01792 001350

Email: [email protected]

Office: Vivian House, Roman Bridge Close, Mumbles, Swansea, SA3 5BG

Interacted with Miller and Partner on LinkedIn regarding my public liability insurance. After a brief chat about my requirements 2 deals were done at I would say better than reasonable rates. Highly recommend this company for all your insurance needs.

Office: Vivian House, Roman Bridge Close, Mumbles, Swansea, SA3 5BG

Call 01792 001350

Email: [email protected]